- China Envoy Sends Letter to UN Chief Over Japan’s Taiwan Remarkpor Jenni Marsh, Jing Li on noviembre 22, 2025 at 6:49 am

China sent a letter to the United Nations vowing resolute self-defense if Japan “dared to intervene militarily in the Taiwan Strait,” as Beijing tries to rally international support for its position on the spiraling spat.

- S&P Removes Zambia’s Default Rating on Debt Recast Progresspor Matthew Hill on noviembre 22, 2025 at 6:48 am

S&P Global Ratings removed its default rating for Zambia, five years after the country missed a dollar bond payment in 2020 and became Africa’s first pandemic-era sovereign defaulter.

- Britain’s Economic Malaise May Soon Come to Americapor Merryn Somerset Webb on noviembre 22, 2025 at 6:30 am

In the middle of 2022, UK households were saving around 5% of their incomes. By the end of 2024, they were saving more than 11%. One day everyone felt pretty good about the future. Spend spend spend. The next they were frantically hoarding cash. So what happened?

- Trump’s Boycott of G-20 Shrouds South Africa Summiton noviembre 22, 2025 at 6:29 am

Follow live updates from the G-20 Leaders’ Summit in Johannesburg

- South Africa’s Municipal Vote Seen Testing Coalition Stabilitypor Alexander Parker on noviembre 22, 2025 at 6:00 am

Upcoming municipal elections will test the durability of South Africa’s ruling alliance, with its members set to compete fiercely for control of local councils, the nation’s deputy finance minister said.

- TPG, Warburg Weigh $500 Million Stake in India-Rooted Sirionpor Ranjani Raghavan, Baiju Kalesh on noviembre 22, 2025 at 3:40 am

TPG Capital LP and Warburg Pincus are in early talks to buy a stake in Sirion Labs Pvt., a Partners Group Holding AG-backed software business managing and automating contracts, according to people familiar with the matter.

- Marjorie Taylor Greene to Quit Congress After Trump Feudpor Erik Wasson on noviembre 22, 2025 at 1:21 am

Marjorie Taylor Greene, a Georgia Republican who was among President Donald Trump’s strongest allies in Congress before their relationship fell apart, will resign from Congress in January.

- Supreme Court Revives GOP-Drawn Texas Voting Map for Nowpor Greg Stohr on noviembre 22, 2025 at 12:51 am

US Supreme Court Justice Samuel Alito temporarily restored a Republican-drawn congressional map in Texas, acting little more than an hour after the state and its GOP leaders sought emergency intervention.

- Carlyle-Backed Defense Contractor Pulls $2.3 Billion Loan Salepor Aaron Weinman, Jeannine Amodeo on noviembre 22, 2025 at 12:08 am

Defense and cybersecurity contractor ManTech International Corp. scrapped a planned $2.3 billion leveraged loan sale amid weak demand, according to people with knowledge of the matter, opting to raise funds from private credit lenders instead.

- Stocks Steady After Volatile Week as Bitcoin ETFs See Major Outflows | The Close 11/21/2025on noviembre 22, 2025 at 12:06 am

Bloomberg Television brings you the latest news and analysis leading up to the final minutes and seconds before and after the closing bell on Wall Street. Today’s guests are Morgan Stanley’s Michelle Weaver, Loop Capital Markets’ Anthony Chukumba, Cambridge Associates’ Andrea Auerbach, JP Morgan Asset Management’s Meera Pandit, Centerbridge Partners’ Jeff Aronson, Catch Hospitality Group’s Eugene Remm, Levain Bakery’s Connie McDonald and Pam Weekes. (Source: Bloomberg)

- Saudi Arabia’s Deepening Ties to the US and What It Means for Investorson noviembre 22, 2025 at 12:05 am

After President Trump gave a royal welcome to Saudi Arabia’s Crown Prince Mohammed bin Salman, the Kingdom’s strategic shift from petrochemicals to technology is expected to materialize in the form of investment. We break down what investors can expect with Basilinna’s Deborah Lehr and Council on Foreign Relations’ Steven Cook. (Source: Bloomberg)

- Tea Mogul to Marry Solar Heiress in China’s High-Society Weddingpor Filipe Pacheco, Ocean Hou on noviembre 22, 2025 at 12:00 am

The wedding of a tea-shop chain entrepreneur and a solar-panel heiress is set to offer a rare glimpse into the next generation of China’s ultra-wealthy.

- Japan’s Takaichi Faces Market Tests From Yen to Stocks and Bondspor Hideyuki Sano, John Cheng, Momoka Yokoyama on noviembre 22, 2025 at 12:00 am

Markets have lost their enthusiasm for Japan’s new Prime Minister Sanae Takaichi, with about $127 billion wiped off the value of Tokyo-listed stocks over the past week and sharp declines in the yen and government bonds.

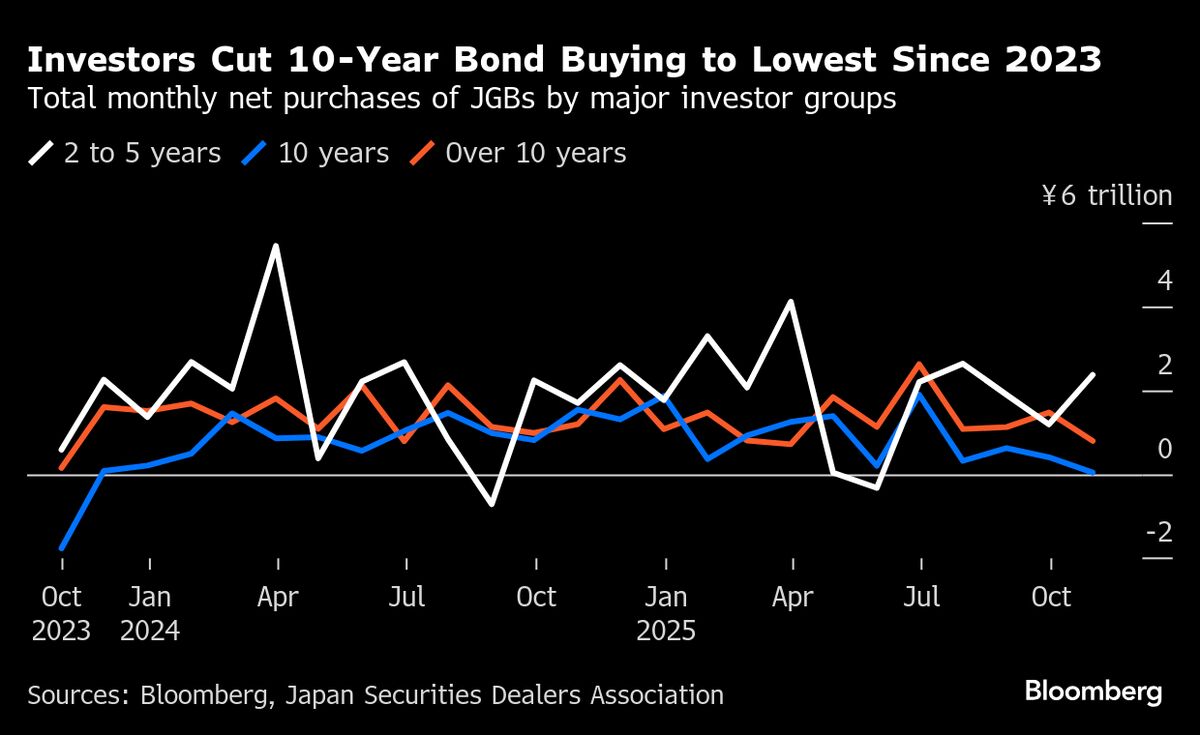

- Five Charts Show Pressure Ramping Up on Japan’s Bonds and Yenpor Masaki Kondo on noviembre 22, 2025 at 12:00 am

Japanese markets have had a turbulent week as both the yen and government bonds were pressured by fears sparked by Prime Minister Sanae Takaichi’s large spending plans.

- Texas Asks Supreme Court to Restore GOP-Drawn Voting Mappor Greg Stohr on noviembre 21, 2025 at 11:31 pm

Texas and its Republican leaders asked the US Supreme Court to reinstate a GOP-drawn congressional map in a clash that could determine which party controls the House after next year’s midterm election.

- Bill Ackman Prepares for 2026 Pershing Square IPO, FT Sayspor Katherine Burton on noviembre 21, 2025 at 11:27 pm

Billionaire hedge fund manager Bill Ackman is revving up a long-anticipated plan to hold an initial public offering for his Pershing Square Capital Management, the Financial Times reported, citing unidentified people with knowledge of the matter.

- JPM’s Pandit: Uptick in Unemployment is Concerningon noviembre 21, 2025 at 11:27 pm

Meera Pandit, Executive Director and Global Market Strategist at JPMorgan Asset Management, says the Fed may hold rates in December and then cut gradually next year, likely no more than two to three times. She tells Katie Greifeld and Romaine Bostick on “The Close” that the recent uptick in unemployment is concerning. (Source: Bloomberg)

- BofA Tower Gets Chicago’s Biggest Mortgage Bond Deal Since Covidpor Scott Carpenter on noviembre 21, 2025 at 11:14 pm

A mortgage loan for Chicago’s Bank of America Tower is being refinanced with $700 million in bonds, a rare bright spot for the city’s beaten-down real estate market, according to people familiar with the matter.

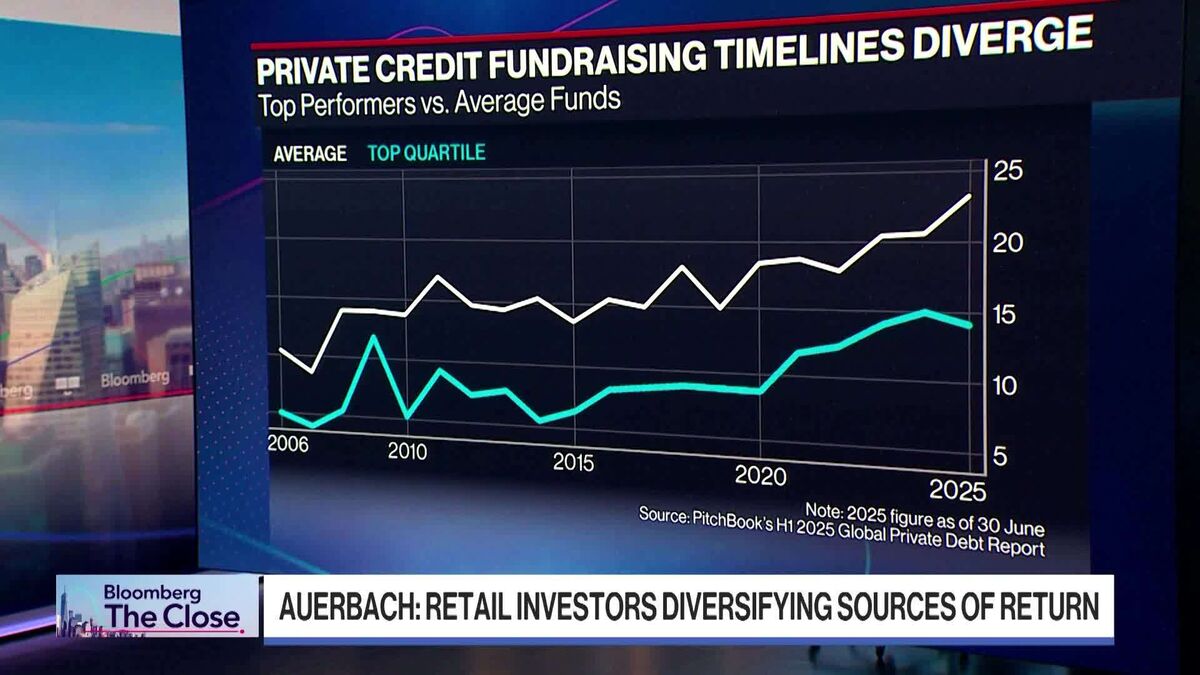

- Private Markets Have Troughed: Cambridge’s Auerbachon noviembre 21, 2025 at 11:08 pm

Andrea Auerbach, Cambridge Associates’ Global Head of Private Investments, says the firm expects private markets to trough in 2026, with stronger exit and fundraising activity than in 2025. She tells Romaine Bostick and Katie Greifeld on “The Close.” (Source: Bloomberg)

- Levain Bakery Co-Founders on New Book, Expansion Planson noviembre 21, 2025 at 10:58 pm

Connie McDonald and Pam Weekes, co-founders of Levain Bakery, discuss rising food costs, consumer strength, and the release of their first cookbook with Romaine Bostick and Katie Greifeld on “The Close.” McDonald says people always seem to want a treat, “in good times or bad.” (Source: Bloomberg)

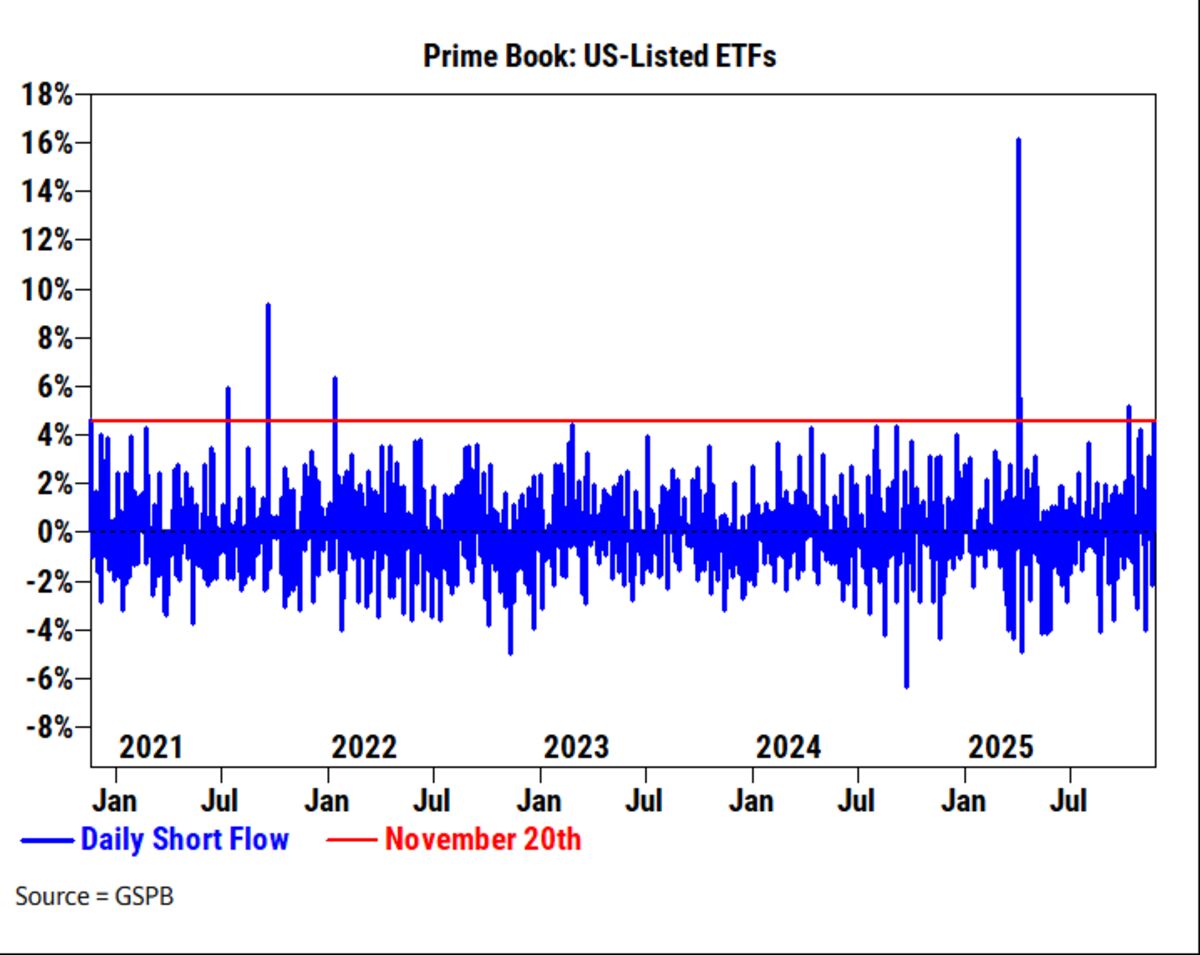

- Hedge Funds Scramble to Cover Short Positions as Stocks Reboundpor Natalia Kniazhevich on noviembre 21, 2025 at 10:54 pm

Hedge funds were caught on the wrong side of a sharp two-day swing in the stock market, rushing to protect against losses on Thursday only to unwind those positions a day later as prices snapped back.

- Europe Scrambles for Time After US Sets Ukraine an Ultimatumpor Natalia Drozdiak, Samy Adghirni, Daryna Krasnolutska, Michael Nienaber on noviembre 21, 2025 at 10:25 pm

European leaders are desperately trying to buy Ukraine more time to work out a new ceasefire framework with Russia after the Trump administration imposed a Thanksgiving deadline, with top US officials hammering the point that this is turning into an ultimatum.

- Centerbridge’s Aronson Defends Private Credit: ‘Take a Breath’on noviembre 21, 2025 at 10:13 pm

Jeff Aronson, Centerbridge Partners co-founder and managing principal, says to call private credit and direct lending «garbage lending» is an overstatement. Speaking on «Bloomberg The Close,» Aronson says there are always peaks and valleys in lending. DoubleLine Capital CEO and founder Jeffrey Gundlach called private credit «garbage lending» earlier this week. (Source: Bloomberg)

- Trump and Mamdani Find Common Ground in Their Goals For NYCpor Hadriana Lowenkron, Joe Sobczyk on noviembre 21, 2025 at 9:56 pm

Both men move past the harsh words of the campaign.

- RTX Joint Venture Wins Contract to Make Iron Dome Missiles in USpor Jen Judson on noviembre 21, 2025 at 9:52 pm

RTX Corp. and Israeli defense firm Rafael have won a $1.25 billion contract to build surface-to-air missiles for Israel’s Iron Dome air-defense system at a new plant in Arkansas, the joint venture announced.

- Oracle Slump Sends Ellison Sliding Down Ranks of World’s Richestpor Dylan Sloan on noviembre 21, 2025 at 9:47 pm

A frenzied, AI-fueled rally in Oracle Corp. stock briefly made Larry Ellison the world’s richest person in September. But a prolonged slump since then has seen the tech giant give up all those gains and more, delivering a $130 billion hit to Ellison’s net worth.

- San Francisco Hotels That Echoed City’s Decline Sell for 75% Offpor Patrick Clark on noviembre 21, 2025 at 9:42 pm

A pair of San Francisco hotels whose travails exemplified a fallen commercial real estate market are changing hands, marking a milestone in the city’s comeback story as it attracts some of the world’s largest investors.

- Italy Wins First Moody’s Upgrade Since 2002 in Meloni Winpor Alessandra Migliaccio on noviembre 21, 2025 at 9:42 pm

Italy achieved its first upgrade from Moody’s Ratings in more than 23 years, a victory for Premier Giorgia Meloni that ends an era when the country teetered at the brink of junk.

- Italy Wins First Moody’s Upgrade Since 2002 in Meloni Winpor Alessandra Migliaccio on noviembre 21, 2025 at 9:42 pm

Italy achieved its first upgrade from Moody’s Ratings in more than 23 years, a victory for Premier Giorgia Meloni that ends an era when the country teetered at the brink of junk.

- Wild Ride on Wall Street as the Crypto Crash Spooks Risk Complexpor Denitsa Tsekova, Geoffrey Morgan on noviembre 21, 2025 at 9:40 pm

Wall Street’s risk machine didn’t break this week — Friday’s rebound spared it. But it flinched. And in doing so, it revealed how fragile the current market cycle has become.

- Consumer Sentiment Falls to Near Record Lows | Bloomberg Businessweek Daily 11/21/2025on noviembre 21, 2025 at 9:36 pm

On today’s episode of Bloomberg Businessweek Daily, Carol Massar and Tim Stenovec discuss the US consumer sentiment falling to near lowest on record. Ernst & Young Chief Economist Greg Daco joins the show to break down the three ‘A-Pillars’ propping up the economy. Also on today’s show, Tikehau Capital’s Raphael Thuin on European stocks wavering as AI trade and Fed policy dominate market sentiment, and Pittsburgh International Airport CEO Christina Cassotis talks holiday travel outlook, new terminal design, and post-shutdown travel recovery. (Source: Bloomberg)

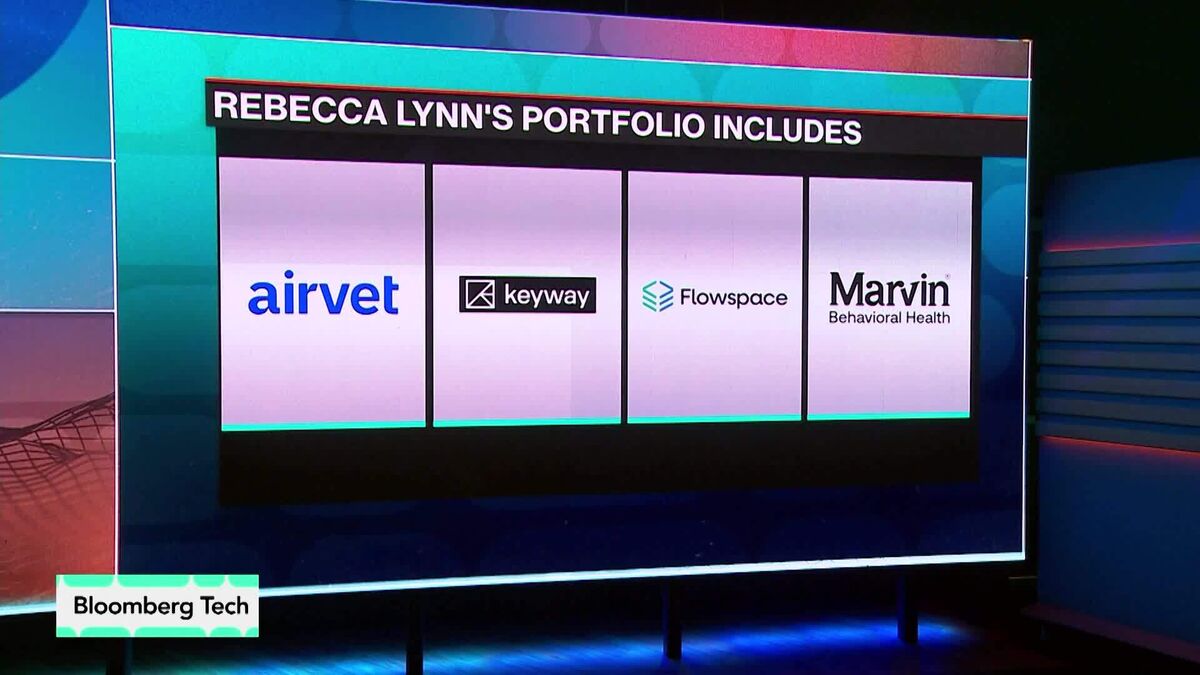

- Canvas Prime’s Lynn: Looking for Right Deal, Not Hype Dealon noviembre 21, 2025 at 9:28 pm

Rebecca Lynn, managing director for Canvas Prime, says she has no doubt the market is in an AI bubble and that requires venture backers to look more carefully at startups’ customers, revenue expectations, and governance structures. She joins Caroline Hyde on “Bloomberg Tech.” (Source: Bloomberg)

- Bahrain Gets First S&P Downgrade Since 2017 as Debt Woes Persistpor Abeer Abu Omar on noviembre 21, 2025 at 9:25 pm

S&P Global Ratings downgraded Bahrain for the first time since 2017 as the Gulf country’s fiscal position deteriorates and debt levels rise.

- Bahrain Gets First S&P Downgrade Since 2017 as Debt Woes Persistpor Abeer Abu Omar on noviembre 21, 2025 at 9:25 pm

S&P Global Ratings downgraded Bahrain for the first time since 2017 as the Gulf country’s fiscal position deteriorates and debt levels rise.

- Trump Says He’d ‘Feel Very Comfortable’ in Mamdani’s NYCpor Skylar Woodhouse, Katia Porzecanski on noviembre 21, 2025 at 9:22 pm

President Donald Trump said he wants to see Zohran Mamdani succeed, saying after a highly anticipated sitdown that he’d “feel very comfortable” living in a New York run by the mayor-elect and that he doesn’t anticipate cutting off funding for the country’s most populous city.